Value Added Tax FAQs

Learn how Value Added Tax (VAT) will affect your monthly invoice.

What Is VAT?

VAT – Value Added Tax – is a type of consumption tax that is applied to the sale of goods and services. The amount applied depends on the fiscal rate established by your country of residence.

Influencity determines the amount charged when you register your company on the platform and enter your fiscal registration details.

When Is VAT Applied?

There are 3 possible VAT rates, depending on the country where your business in located.

1. Companies registered in Spain

If your small business or enterprise is registered in Spain, the 21% VAT rate will be applied to all of your invoices. This is determined when you register.

2. Companies registered in the European Union

Businesses registered in an EU member state will pay the VAT rate specified by the country where they are located. For more information on this, please refer to the fiscal and tax policies of your country of residence.

3. Companies registered elsewhere

Businesses located outside of Spain and the EU will not be charged VAT.

VIES Exemptions for EU Countries

If your business is registered within the VIES (VAT Information Exchange System), you may be exempt from paying the VAT. To verify if your company is registered to trade cross-border in the EU, please consult the EU’s VIES on the web tool.

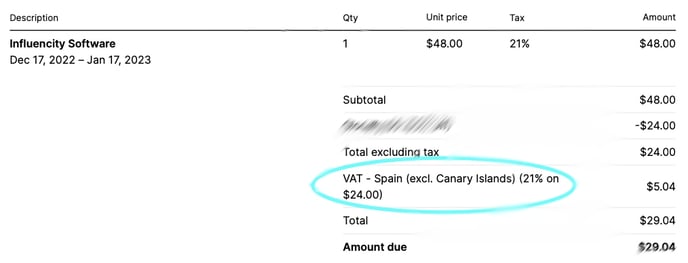

Where Does VAT Appear on My Invoice?

If a VAT rate has been applied to your monthly invoice, this will appear on your bill as below:

To view your invoice, follow these steps.